| Essex Property: Derailed By The Fed's Rampage (NYSE:ESS) | 您所在的位置:网站首页 › buy rampage › Essex Property: Derailed By The Fed's Rampage (NYSE:ESS) |

Essex Property: Derailed By The Fed's Rampage (NYSE:ESS)

|

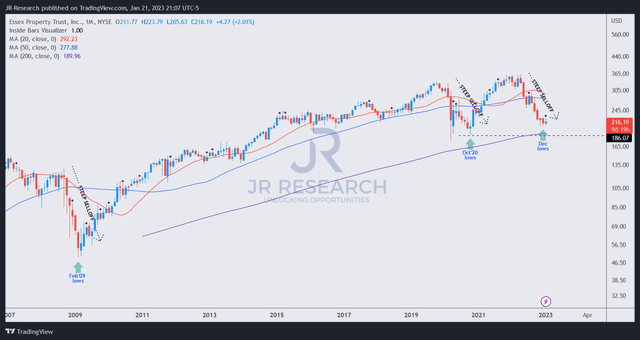

Drew Angerer Nothing could stand in the way of Fed Chair Jerome Powell & his FOMC when they decided to go on a rampage to curtail record levels of inflation rates that likely topped out in June 2022 (CPI YoY: 9.1%). Even the formidable leading West Coast apartment REIT Essex Property Trust, Inc. (NYSE:ESS) couldn't run from the Fed's record hiking spree, as ESS fell dramatically from its April 2022 highs. Accordingly, ESS declined nearly 45% from its April highs toward its recent December lows, significantly underperforming the S&P 500 (SPX) (SPY). Hence, we believe weak ESS holders have likely bailed, fearing worse is yet to come, as market forecasters jostle between projecting no recession, mild recession, or an earnings recession in 2023. Notwithstanding, a recent Fed study shows that Powell and his team could "bring inflation down without triggering the huge jumps in unemployment." Fed officials have also been sending mixed signals lately, even as they generally favored tapering the hiking cadence. While a 25 bps hike is seemingly the consensus view, it could be premature to expect the Fed to pivot earlier as it seeks to reach its 2% price stability goal with an unflinching commitment. Hence, ESS investors need to assess whether the consolidation zone since early November 2022 could sustain against a potential further onslaught by the Fed as it continues to hike rates, albeit at a slower pace. Notably, ESS' NTM dividend yield has risen significantly to 4.24%, well above its 10Y average of 3%. However, with 2Y Treasury yields posting 4.17%, we aren't surprised that the battering in ESS is closely intertwined with the surge in the 2Y. Therefore, we believe ESS investors should pay more attention to the Fed's conversation as buyers likely need the "Fed pivot" conviction to return to ESS in droves. ESS investors must also question why buyers would return to ESS with attractive Treasury yields and potentially benefit from price-performance gains when the yields subside. With a delta of fewer than 10 bps between the 2Y and ESS' dividend yield, we don't think it's surprising that market operators have not returned in waves to bolster the upward recovery in ESS. The apartment rental market remains in the doldrums, which is good news. Why? It should be evident by now that the Fed's key message is to reach its price stability goal. Given the incredible surge in the apartment rental market, driven by the pandemic-fueled excesses, an extended normalization should be expected and welcome. While the recent bad news from tech companies continuing their layoffs isn't constructive, management highlighted that while Essex's portfolio leverages the growth of the tech sector, its fate is not sealed by a tech downturn. Outgoing CEO Michael Schall accentuated: Our portfolio is not positioned to be near the tech companies per se or to cater to the tech employees. We are trying to cater to the broad range of employment within our markets. So we do have a couple of buildings that are predominantly tech-related employees, but it's the exception and actually not even close to the average. So we are a reflection of the broader economy and therefore, the tech component in Northern California and Seattle will be more, but there's a lot of, there's a pretty diverse job base there in general. (Essex Property FQ3'22 earnings call) Notwithstanding, while the job market has remained resilient, the WSJ reported that "unemployed Americans are spending more time out of work as employers slow down hiring." However, that shouldn't be unexpected, with companies cutting capital spending and corporate IT budgets. Moreover, in the recent World Economic Forum Davos 2023, global CEOs also highlighted their concerns about an ominous 2023 fraught with geopolitical uncertainties and global macroeconomic challenges. As such, ESS investors should continue to expect negative news emanating from the mainstream media, testing the nerves of even high-conviction investors. But ESS holders need to be resolute here; if you still have not bailed. ESS price chart (monthly) (TradingView) As seen above, ESS investors have witnessed such a massive selloff only two other times in its long-term price chart; during the 2007/08 global financial crisis and the 2020 COVID pandemic. The price action is logarithmically configured, so the extent of the selloff can be more easily comparable. ESS remains well-undergirded above its critical 200-month moving average or MA, suggesting that long-term buyers have not lost their conviction. In other words, if you bail out now, you could be leaving at the lows even as the Fed reaches peak hawkishness. And if you are confident that the economy will not fall into a deep recession, its November/December lows could help form the bottoming process of a historical selloff in ESS. Rating: Buy. Do you want to buy only at the right entry points for your growth stocks?We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes: 24/7 access to our model portfolios Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster Access to all our top stocks and earnings ideas Access to all our charts with specific entry points Real-time chatroom support Real-time buy/sell/hedge alerts Sign up now for a Risk-Free 14-Day free trial!

|

【本文地址】